- Long term capital appreciation

- Investments in equity and equity related instruments across large cap, mid cap, small cap stocks

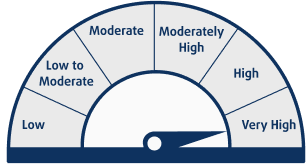

*Investor should consult their financial advisor if they are not clear about the suitability of the product.

#It may be noted that the scheme risk-o-meter specified above is based on the internal assessment of scheme characteristics and may vary post NFO, when the actual investments are made. The same shall be updated in accordance with the provisions of SEBI circular dated October 5, 2020 on Product labeling in mutual fund schemes on ongoing basis.