-

Fund Type : An open ended debt scheme investing in money market instruments. A Relatively Low interest rate risk and Moderate Credit RiskEntry Load : NilDate of Allotment : February 04, 2025

-

Benchmark :CRISIL Money Market A-1 IndexExit Load :Nil

Investment Objective

The investment objective is to generate returns with reasonable liquidity to the unitholders by investing in money market instruments. There is no assurance that the investment objective of the Scheme will be achieved.

Fund Manager

-

Mr. Mithraem Bharucha

BMS and MBA

See detail

See detail

Fund Highlights

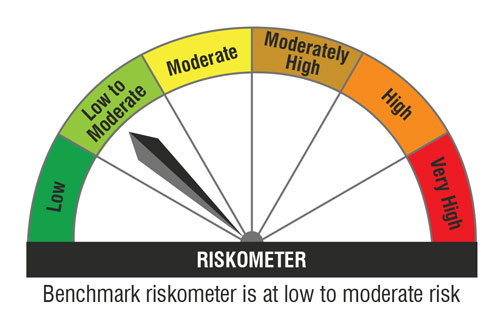

Riskometer

| Potential Risk Class Matrix | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Credit Risk | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) | ||||||

| Interest rate Risk | |||||||||

| Relatively Low (Class I) | B-1 | ||||||||

| Moderate (Class II) | |||||||||

| Relatively High (Class III) | |||||||||