Data as on 04th feb 2025

Bank Of India Ultra Short Duration Fund

-

Fund Type : An open ended ultra-short term debt scheme investing in instruments with Macaulay duration of the portfolio between 3 months and 6 months. A Relatively Low Interest Rate Risk and Moderate Credit Risk.Entry Load : NilDate of Allotment : July 16, 2008

-

Benchmark :Tier 1: CRISIL Ultra Short Duration Debt A-I IndexExit Load :Nil

Investment Objective

The Scheme seeks to deliver reasonable market related returns with lower risk and higher liquidity through portfolio of debt and money market instruments. The Scheme is not providing any assured or guaranteed returns. Further there is no assurance that the investment objectives of the Scheme will be realized.

Fund Manager

-

Mithraem Bharucha

BMS and MBA

See detail

See detailOver 13 years of experience in Fixed Income market domain, Investment strategy development.

Fund Highlights

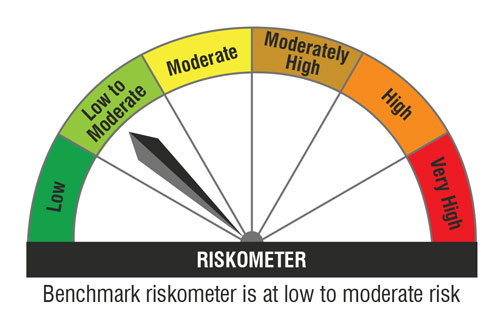

Riskometer

| Potential Risk Class Matrix | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Credit Risk | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) | ||||||

| Interest rate Risk | |||||||||

| Relatively Low (Class I) | B-I | ||||||||

| Moderate (Class II) | |||||||||

| Relatively High (Class III) | |||||||||

Top 10 Portfolio Holdings

Credit Profile

Asset Allocation

Performance(Regular Plan – Growth)

| 1 yr | 6.7 % | 7.5 % |

| 3 yrs | 5.9 % | 6.8 % |

| 5 yrs | 5.1 % | 5.9 % |

IDCW History

| CLICK HERE TO VIEW THE IDCW HISTORY |