-

Fund Type : An open ended equity scheme investing across large cap, mid cap, small cap stocksEntry Load : NADate of Allotment : March 03, 2023

-

Benchmark :NIFTY 500 Multicap 50:25:25 Total Return Index (TRI)Exit Load :

Investment Objective

The investment objective of the scheme is to generate long term capital appreciation by investing in equity and equity-related securities across various market capitalisation. However, there can be no assurance that the investment objectives of the Scheme will be realized.

Fund Manager

-

Nitin Gosar

B.M.S and MS Finance (ICFAI)

See detail

See detailMore than 16 years of Experience in equity Research and Fund Management.

Fund Highlights

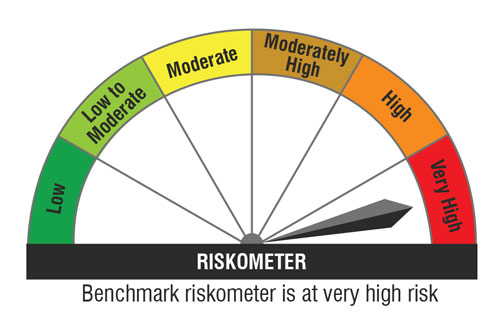

Riskometer

Top 10 Portfolio Holdings

Sector Allocation

- Portfolio weight (%)

- Benchmark weight (%)

Who Should Invest

- Suitable for investors looking for a single product solution for equity investment

- Suitable for investors looking to invest in opportunities across the market cap (large, mid and small)

- Suitable for investors seeking to optimise returns while minimising volatility

- Suitable for investors with 5 years or longer investment horizon

Multi Cap Allocation Strategy

- ( =>25% ) LARGE CAP - Stable growth, cash flow and return ratios

- ( =>25% ) MID CAP - Better growth, efficient redeployment of capital

- ( =>25% ) SMALL CAP - Unique positioning, emerging business offering better growth, scalable business, operating leverage and ROCE expansion

- ( 0%-25% ) DYNAMIC* -‘North star’ – guiding path Absolute valuation vis-à-vis its historical mean Relative valuation among the different market cap indices *Dynamic 0-25% Equity, 0-25% Debt & Money Market, 0-10% REITs & INVITs