Data as on 30th April 2024

Bank Of India Bluechip Fund

-

Fund Type : An open ended equity scheme predominantly investing in Large cap stocksEntry Load : NADate of Allotment : June 29,2021

-

Benchmark :NIFTY 100 TRI (Tier 1)Exit Load :

Investment Objective

The investment objective of the scheme is to provide investors with the opportunities for long term capital appreciation by investing predominantly in equity and equity-related instruments of large cap companies. However, there can be no assurance that the income can be generated, regular or otherwise, or the Investment Objective of the scheme will be realized.

Fund Manager

ALOK SINGH

CFA and PGDBA

from ICFAI Business School See detail

See detailMr. Nilesh Jethani

See detail

See detail

Fund Highlights

Riskometer

Top 10 Portfolio Holdings

Sector Allocation

- Portfolio weight (%)

- Benchmark weight (%)

Who Should Invest

- Bank of India Bluechip Fund is an Equity fund investing in Large cap equity stocks (i.e. 1 to 100 stocks by market capitalization).

- The scheme can also invest upto 20% of its portfolio in Mid & Small cap stocks. The fund is suited to investors with conservative risk profile or first time investors.

Why invest in large cap companies

- Large Cap companies - With established businesses and long track records these companies generally are segment leaders with high market share commanding economies of scale.

- Strong ability to withstand economic and business cycle downturns.

- High liquidity

- Broader research coverage by analysts.

- High institutional ownership (DIIs and FIIs) - Institutions own more than 1/3rd of the large cap universe.

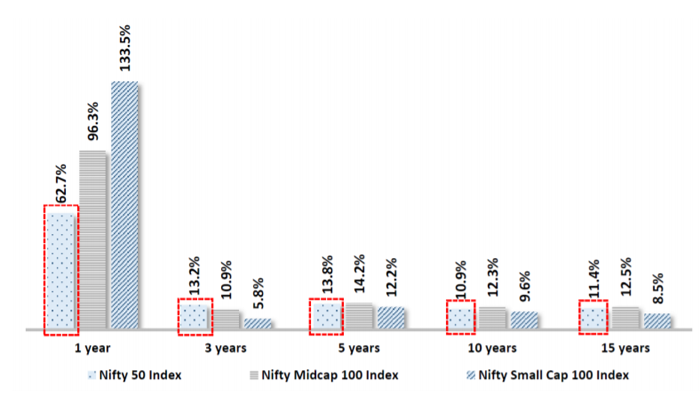

Large Cap index has given consistent returns over the long term

Large Caps have been able to deliver consistent performance across all timeframes compared to other market cap categories.

Note: CAGR Returns as of May 31, 2021; Past Performance may or may not be sustained in future.

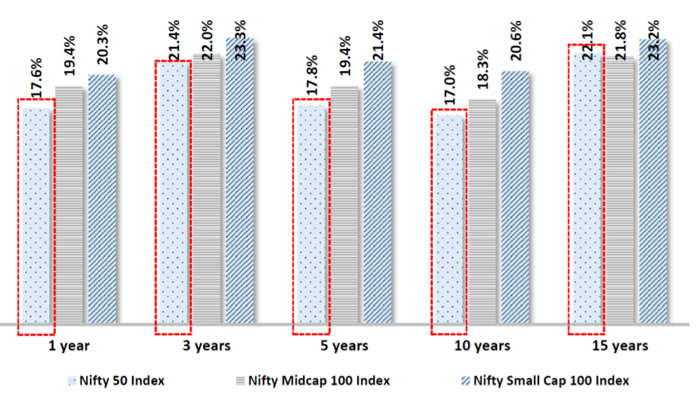

Large Cap Index has shown lower volatility

Volatility in Large Caps is lowest across almost all time periods and may be considered good investment choice to investors on risk adjusted basis.

Note: All calculations as of May 31, 2021.

| 1 yr | 0.0 % | 0.1 % |

| 3 yrs | 0.2 % | 0.2 % |

IDCW History(Regular Plan - Regular IDCW)

| Record Date | IDCW (₹/Unit) |

| 30-June-2021 | 1.25 |

| 29-July-2021 | 1.00 |

| CLICK HERE TO VIEW THE IDCW HISTORY |