Data as on 04th feb 2025

Bank Of India ARBITRAGE FUND

-

Fund Type : An open ended scheme investing in arbitrage opportunitiesEntry Load : NilDate of Allotment : June 18, 2018

-

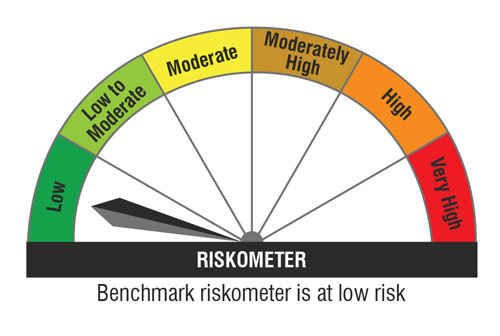

Benchmark :Nifty 50 Hybrid Composite Debt 50: 50 (TRI)Exit Load :

Investment Objective

The Scheme seeks to generate income through arbitrage opportunities between cash and derivative segments of the equity market and arbitrage opportunities within the derivative segment and by deployment of surplus cash in debt securities and money market instruments. However, there is no assurance or guarantee that the investment objective of the scheme will be realized

Fund Manager

Mr. Firdaus Ragina

See detail

See detail

Fund Highlights

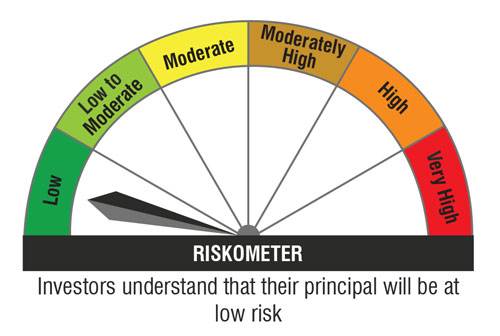

Riskometer

Top 10 Portfolio Holdings

Who should invest?

IDCW History(Regular Plan- Annual IDCW)

| Record Date | IDCW (₹/Unit) |

| 27-April-2020 | 0.05385541 |

| 27-April-2020 | 0.05385543 |

| 26-May-2020 | 0.04345086 |

| 26-May-2020 | 0.04345088 |

| CLICK HERE TO VIEW THE IDCW HISTORY |