Data as on 04th feb 2025

Bank Of India Large & Mid Cap Equity Fund

-

Fund Type : An Open Ended Equity Scheme investing in both large cap and mid cap stocksEntry Load : NilDate of Allotment : October 21, 2008Features : SIP SWP

-

Benchmark :BSE 250 LargeMidCap (TRI)Exit Load :

Investment Objective

The Scheme seeks to generate income and long-term capital appreciation by investing through a diversified portfolio of predominantly large cap and mid cap equity and equity related securities including equity derivatives. The Scheme is in the nature of large and mid cap fund. The Scheme is not providing any assured or guaranteed returns

Fund Manager

-

Nitin Gosar

B.M.S and MS Finance (ICFAI)

See detail

See detail

Fund Highlights

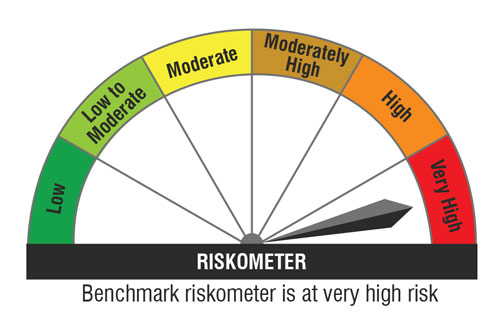

Riskometer

Top 10 Portfolio Holdings

Sector Allocation

- Portfolio weight (%)

- Benchmark weight (%)

Performance(Regular Plan – Growth)

| 1 yr | -4.7 % | 0.3 % |

| 3 yrs | 12.1 % | 12.4 % |

| 5 yrs | 15.9 % | 17.5 % |

IDCW History(Regular Plan- Regular IDCW)

| Record Date | IDCW (`/Unit) |

| 25-March-2021 | 0.90 |

| 29-July-2021 | 0.25 |

| CLICK HERE TO VIEW THE IDCW HISTORY |