Data as on 04th feb 2025

-

Fund Type : An Open Ended Hybrid Scheme investing predominantly in debt instrumentsEntry Load : NilDate of Allotment : March 18, 2009

-

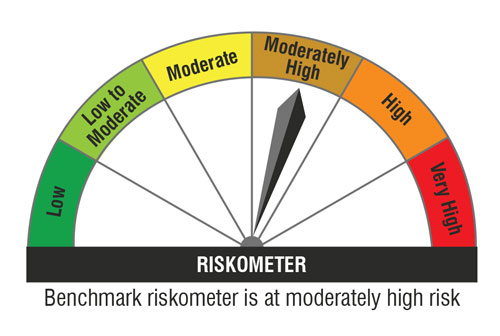

Benchmark :CRISIL Hybrid 85 + 15 - Conservative IndexExit Load :

Investment Objective

The Scheme seeks to generate regular income through investments in fixed income securities and also to generate long term capital appreciation by investing a portion in equity and equity related instruments. However, there can be no assurance that the income can be generated, regular or otherwise, or the investment objectives of the Scheme will be realized.

Fund Manager

-

Alok Singh

CFA and PGDBA from ICFAI Business School.

See detail

See detailAround 20 years of experience, including 16 years in mutual fund industry.

He is managing this fund since May 21, 2012.

Fund Highlights

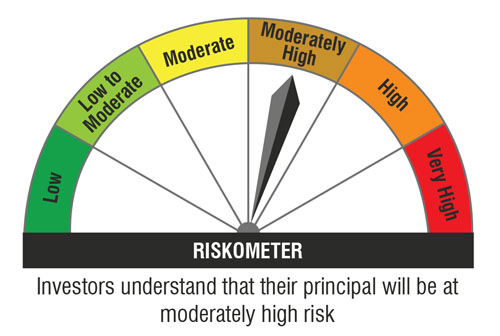

Riskometer

Top 10 Portfolio Holdings

Credit Profile

Asset Allocation

Performance(Regular Plan – Growth)

| 1 yr | 0.6 % | 6.9 % |

| 3 yrs | 12.2 % | 7.4 % |

| 5 yrs | 10.8 % | 8.3 % |

IDCW History(Regular Plan- Annual IDCW)

| Record Date | IDCW (`/Unit) |

| 02-Feb-2021 | 0.23090000 |

| 02-Feb-2021 | 0.23090000 |

| 30-June-2021 | 0.30000000 |

| 30-June-2021 | 0.30000000 |

| CLICK HERE TO VIEW THE IDCW HISTORY |